On May 1, 1961, William H. Reaves and Charles Hewitt founded Reaves, Hewitt & Co., an investment research firm focused on the utilities sector. Bill Reaves was named the Firm’s first President.

Tom Williams was hired as the Firm’s senior utilities analyst. He remained a Reaves employee until 2006.

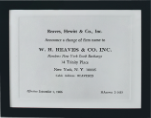

On September 1, 1966, the Firm changed its name to W.H. Reaves & Co., Inc. Bill Reaves continued to serve as the Firm’s President.

Reaves began managing institutional equity accounts with portfolios concentrated in the utilities, energy, and telecommunications sectors.

On February 27, 2004, the Reaves Utility Income Fund debuted on the American Stock Exchange at $20 a share.

On December 22, 2004, Reaves launched an open-end mutual fund.

Ron Sorenson was named the Firm’s Chief Executive Officer and Bill Ferer was named President.

In recognition of the Firm’s focus on the asset management business, W.H Reaves & Co., Inc. began doing business as Reaves Asset Management.

On September 23, 2015, the world’s first actively managed utility sector ETF, the Reaves Utilities ETF debuted on the New York Stock Exchange at $25 a share. The name was subsequently changed to the Virtus Reaves Utilities ETF.

Jay Rhame was appointed Chief Executive Officer and John Bartlett was named President.